Property taxes are a critical component of local government revenue, and in Luzerne County, Pennsylvania, the tax claim process plays a significant role in ensuring fiscal stability for both homeowners and the county itself. Understanding how the Luzerne County tax claim system works is essential for property owners who want to safeguard their assets and avoid potential legal issues. This article delves into the intricacies of Luzerne County tax claims, offering valuable insights and practical advice for residents and property owners.

The Luzerne County tax claim process is designed to recover unpaid property taxes while providing property owners with a fair opportunity to settle their debts. Whether you're a homeowner or an investor looking to acquire tax-delinquent properties, this guide will help you navigate the system effectively. We'll cover everything from the basics of property tax claims to advanced strategies for managing and resolving tax-related issues.

As property taxes continue to be a major concern for residents, staying informed about Luzerne County's tax claim procedures can save you time, money, and stress. By understanding the rules, regulations, and deadlines associated with tax claims, you can make informed decisions that protect your financial interests. Let's dive into the details and explore how the system works.

Read also:Dont Let The Old Man In The Modern Guide To Staying Young At Heart

Understanding Luzerne County Tax Claim Basics

Before diving into the specifics, it's important to grasp the fundamental concepts behind Luzerne County tax claims. Property taxes in Luzerne County are assessed annually, and failure to pay these taxes can result in a tax claim being filed against your property. This section will explain the basic terminology, procedures, and implications of the tax claim process.

What Is a Luzerne County Tax Claim?

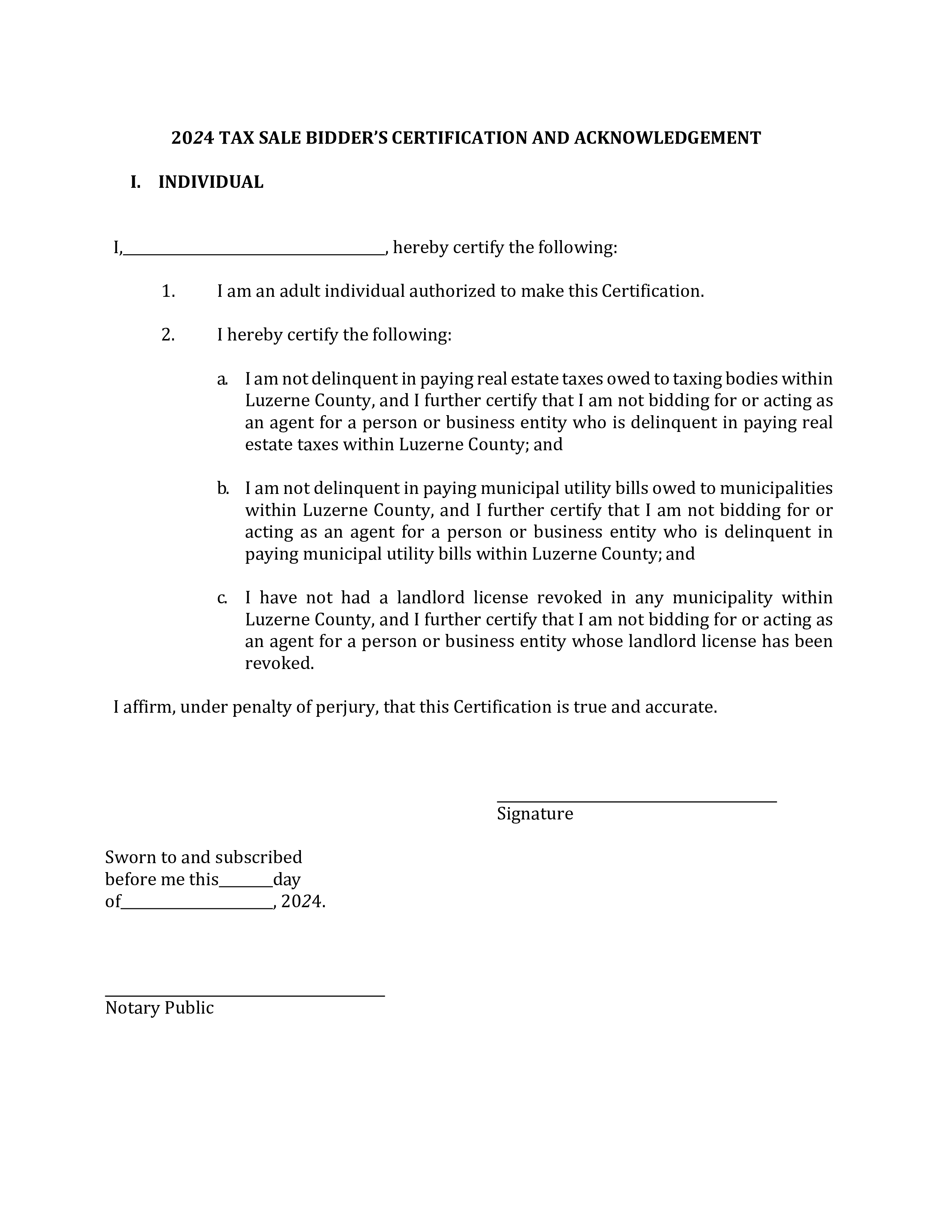

A Luzerne County tax claim refers to the legal action taken by the county to recover unpaid property taxes. When a property owner fails to pay their taxes, the county may initiate a claim process, which involves public auctions or sales of the property to recover the outstanding amount. This process is governed by Pennsylvania's Real Estate Tax Sale Law, ensuring transparency and fairness for all parties involved.

- Tax claims are initiated when property taxes remain unpaid for an extended period.

- The county may auction the property to recover the owed taxes.

- Property owners have the right to redeem their property before the sale.

Key Players in the Tax Claim Process

Several entities and individuals play a role in the Luzerne County tax claim process. Understanding their roles can help you navigate the system more effectively:

- Tax Claim Bureau: Responsible for managing and enforcing property tax claims in Luzerne County.

- Property Owners: Individuals or entities responsible for paying property taxes on their land or buildings.

- Investors: Parties interested in purchasing properties through tax claim auctions.

Eligibility Criteria for Luzerne County Tax Claims

Not all properties are subject to tax claims in Luzerne County. Certain criteria must be met before the county can initiate a claim against a property. This section outlines the eligibility requirements and the conditions under which a tax claim may be filed.

When Can a Tax Claim Be Filed?

A tax claim can be filed when a property owner fails to pay their property taxes for a specified period. In Luzerne County, the Tax Claim Bureau typically allows a grace period before initiating legal action. During this time, property owners are encouraged to settle their outstanding balance to avoid further consequences.

Exemptions and Special Considerations

Some properties may qualify for exemptions or special considerations that delay or prevent tax claims. These exemptions are often granted based on factors such as:

Read also:Prince Charming Shrek The Unlikely Hero In A World Of Fairy Tales

- Homestead status

- Financial hardship

- Disability or veteran status

Steps in the Luzerne County Tax Claim Process

The tax claim process in Luzerne County follows a structured timeline designed to ensure transparency and fairness. This section breaks down the key steps involved in the process, from initial notification to final resolution.

Step 1: Notification of Delinquent Taxes

When a property owner fails to pay their taxes, the Luzerne County Tax Claim Bureau sends a formal notice of delinquency. This notice outlines the amount owed, deadlines for payment, and potential consequences of non-payment.

Step 2: Redemption Period

Property owners have a redemption period during which they can settle their outstanding tax debt and avoid further legal action. This period typically lasts several months, providing ample time for owners to address their financial obligations.

Step 3: Public Auction

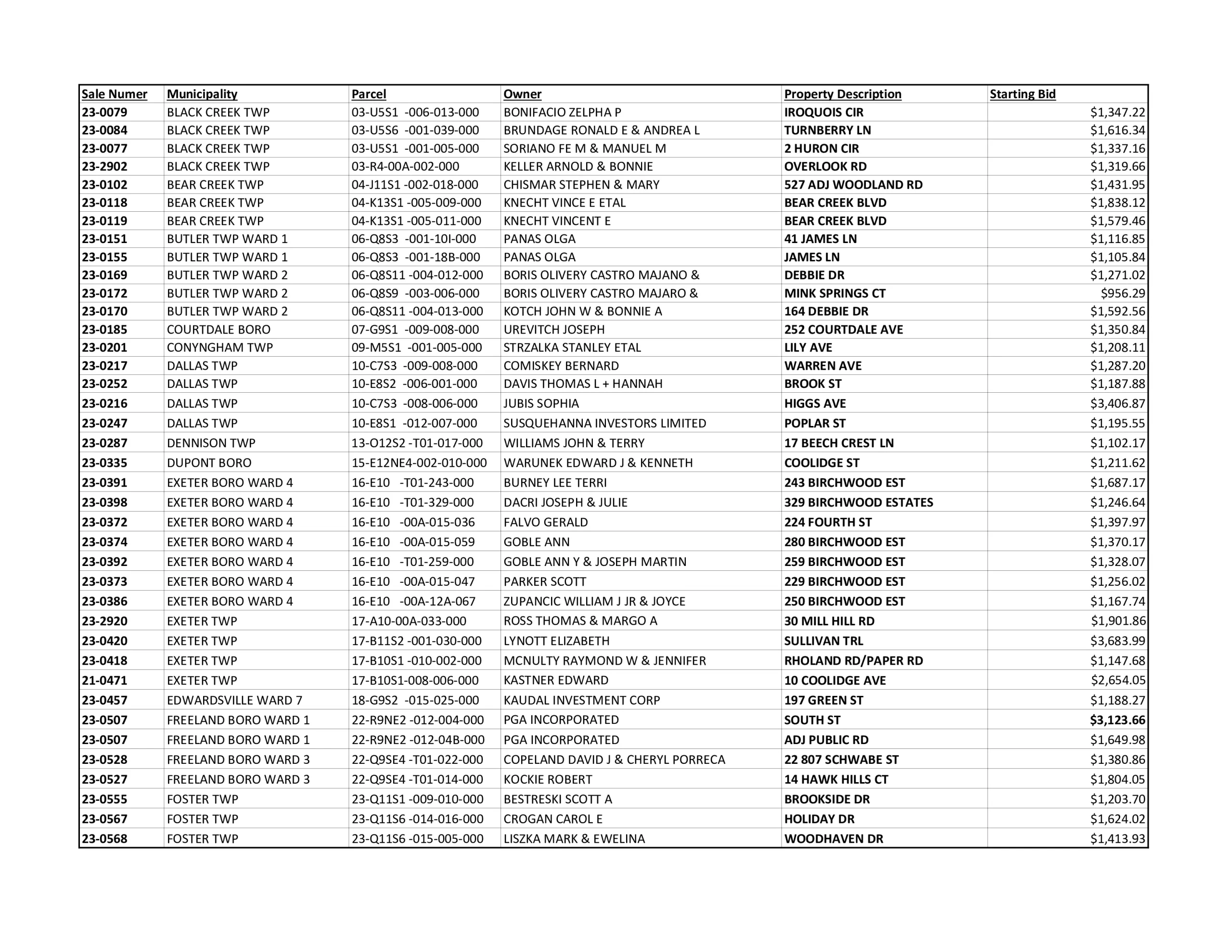

If the property owner fails to redeem their property during the redemption period, the county may proceed with a public auction. During this auction, investors can purchase the property by paying the outstanding tax debt plus associated fees.

Understanding Luzerne County Tax Auctions

Public auctions are a critical component of the Luzerne County tax claim process. This section provides an in-depth look at how these auctions work and what participants can expect.

How Do Tax Auctions Work?

Tax auctions in Luzerne County are conducted to sell properties with delinquent taxes. Interested buyers can bid on these properties, with the highest bidder securing ownership rights. The proceeds from the sale are used to settle the outstanding tax debt.

Benefits and Risks for Investors

Investing in tax-delinquent properties through auctions can be lucrative, but it also carries certain risks. Buyers must carefully evaluate the properties and understand the legal implications of their purchases.

- Benefits: Potential for high returns on investment.

- Risks: Legal challenges or disputes with former owners.

Strategies for Avoiding Luzerne County Tax Claims

Preventing tax claims is often easier and more cost-effective than dealing with the consequences. This section offers practical strategies for property owners to avoid falling into delinquency.

Set Up Automatic Payments

Automating your property tax payments can help ensure that you never miss a deadline. Many banks and financial institutions offer automatic payment services for property taxes.

Stay Informed About Tax Changes

Property tax laws and regulations can change, so staying informed about updates in Luzerne County is crucial. Regularly check the Tax Claim Bureau's website for announcements and changes.

Legal Rights of Property Owners

Property owners in Luzerne County have specific legal rights during the tax claim process. This section explains these rights and how they can be exercised to protect your interests.

Right to Redemption

Property owners have the right to redeem their property by paying the outstanding tax debt before the auction. This right provides a safety net for owners facing financial difficulties.

Appealing Tax Assessments

If you believe your property taxes are unfairly assessed, you have the right to appeal the assessment. This process involves submitting a formal request to the Luzerne County Board of Assessment Appeals.

Impact of Tax Claims on Property Values

Tax claims can significantly impact the value of a property. This section explores the effects of tax claims on property values and provides insights into mitigating these effects.

Short-Term vs. Long-Term Effects

While tax claims may have immediate negative effects on property values, their long-term impact depends on how quickly the issue is resolved. Promptly addressing tax delinquencies can help preserve your property's value.

Data and Statistics on Luzerne County Tax Claims

To provide a clearer picture of the tax claim landscape in Luzerne County, this section presents relevant data and statistics. These figures are sourced from reputable organizations and government reports.

- Approximately 5% of properties in Luzerne County face tax claims annually.

- The average redemption rate is around 70%, indicating that most owners settle their debts before auction.

Conclusion

In conclusion, understanding Luzerne County tax claims is vital for property owners and investors alike. By familiarizing yourself with the process, eligibility criteria, and legal rights, you can effectively manage and resolve tax-related issues. Remember to stay informed about changes in tax laws and take proactive steps to avoid delinquency.

We encourage you to share this article with others who may benefit from the information provided. If you have any questions or feedback, please leave a comment below. For more resources on property taxes and related topics, explore our other articles on the website.

Table of Contents

- Understanding Luzerne County Tax Claim Basics

- Eligibility Criteria for Luzerne County Tax Claims

- Steps in the Luzerne County Tax Claim Process

- Understanding Luzerne County Tax Auctions

- Strategies for Avoiding Luzerne County Tax Claims

- Legal Rights of Property Owners

- Impact of Tax Claims on Property Values

- Data and Statistics on Luzerne County Tax Claims

- Conclusion